Foreign-Trade Zone

The Foreign Trade Zone (FTZ) program was designed to stimulate economic growth and increase competition among nations for employment. While Foreign Trade Zones are often mistakenly referred to as Free Trade Zones the two concepts are very different. The major differences are in the types of business activity allowed in the zone. For example: Free Trade Zones specifically allow retail trade while Foreign Trade Zones can not be used that way. While Free Trade Zones are common throughout the rest of the world, there are none in the United States. However, we have over 250 Foreign Trade Zones.

Foreign-Trade Zones are areas treated, for the purpose of tariff laws and Customs entry procedures, as if outside the U.S. Customs Territory. Foreign and domestic merchandise may enter a zone for storage, assembly, manufacturing, processing or exhibition without being subject to Customs procedures, duties and federal excise taxes. Goods may be manufactured in a FTZ except when specifically limited by law. Customs fees and taxes are due at the time the merchandise leaves the zone. Products may then be exported or sent into U.S. Customs territory, capitalizing on favored tariff rates. If the merchandise is exported from the U.S., duties are eliminated.

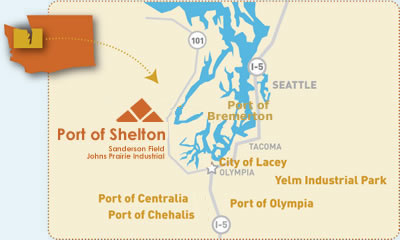

South Puget Sound Foreign-Trade Zone (FTZ) #216.

FTZ 216 is collectively known as South Puget Sound Foreign-Trade

Zone #216 and its service area covers Thurston, Lewis, Mason and

Kitsap counties. It is administratively controlled by the Port of

Olympia.

As part of FTZ 216, the Port of Shelton has two Foreign-Trade Zone (FTZ) sites, one located at Sanderson Field (map) and the other at our Johns Prairie Industrial Park (map).

Benefits of the Program

Duty Deferral

Duties are only paid once the merchandise enters U.S. Customs territory, which allows companies to maintain the cash flow necessary for operating needs. Merchandise can remain in a FTZ for any length of time.

Duty Reduction

Users of a FTZ can elect to pay duties on either the merchandise entering or the finished product, therefore allowing the user to chose a lower duty rate.

Duty Elimination

When merchandise is exported from the FTZ without entering U.S. markets, all duties are eliminated. Duties are generally eliminated on scrapped, wasted, and destroyed merchandise as well.

Zone-to-Zone Transfer

Companies can transfer goods from zone to zone and pay duties only after the goods leave the final zone and enter U.S. Customs territory.

Simplified Customs Reporting

Along with the benefits mentioned above, FTZ’s have a weekly entry procedure, which minimizes merchandise processing and brokers fees.

Types of Foreign Trade Zones

- General-Purpose Zones are typically warehouses offering space for use by importers and exporters. General-purpose zones can be within 60 miles or 90 minutes of a U.S. Port of Entry.

- Subzones are granted to one company per location, typically a manufacturer. Subzones require less frequent on-site visits and less supervision and may be established outside the limits set for general-purpose zones.

- Alternate Site Framework (ASF) is a program which offers greater flexibility to designate and manage general-purpose FTZ sites. In the FTZ 216 service area the Alternate Site Framework allows FTZ designations on virtually any properties within the four county area.

The advantages of the system are:

- Faster return on investment

- Expedited zone start-up

- Lower initial investment cost

- Lower participation barriers to small and medium sized businesses

The nature of your business will determine which zone might be right for you.

Request for Activation

Companies that want to operate under the FTZ system should start by contacting the Port of Shelton with a written request that includes a description of the area required and the nature of the material to be imported. The Port of Shelton will then coordinate with the FTZ 216 Administrator at the Port of Olympia to determine further details of the application process. Ultimate approval of the application comes from the Foreign Trade Zone Board in Washington D.C. Bonds and fees are required as dictated by the circumstances of each application.